These 5 stocks are driving the market – CNN

What’s happening: According to new research from Goldman Sachs, just five companies — Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Tesla (TSLA) and Google parent Alphabet (GOOGL) — have contributed 51% of S&P 500 returns since April. Going back to the beginning of the year, they account for more than a third of the index’s rise.

After shooting up 76% in 2020, Amazon’s stock is up just 6% this year, compared to a nearly 26% rise in the S&P 500. Supply chain problems and pay hikes to recruit and retain workers have eaten into Amazon’s profits despite the ongoing boom in online shopping.

Netflix’s stock has also lost steam, rising 13% this year after skyrocketing 67% in 2020. The company has scored big with shows like “Squid Game,” but investors are worried about whether the company can keep rapidly recruiting subscribers as competition among streaming services grows.

Facebook, now called Meta, has done slightly better, jumping 21% year-to-date. But that leaves it on track for its worst year since 2018, as investors weigh regulatory threats and the social network’s pivot to virtual reality.

Shares in Apple and Google have popped 35% and 69%, respectively. That’s good enough to join the MANTA club.

Tesla also makes the cut. After rising an eye-popping 743% in 2020, shares of Elon Musk’s electric carmaker have kept pushing higher. They’re up 44% since the beginning of 2021 as Wall Street tries to position itself for the green energy transition.

Chipmaker Nvidia, for its part, has shaken off global supply issues and matched 122% gains last year with a 131% increase in 2021. Microsoft’s surging cloud business has driven a 54% stock jump this year, also beating its performance in 2020.

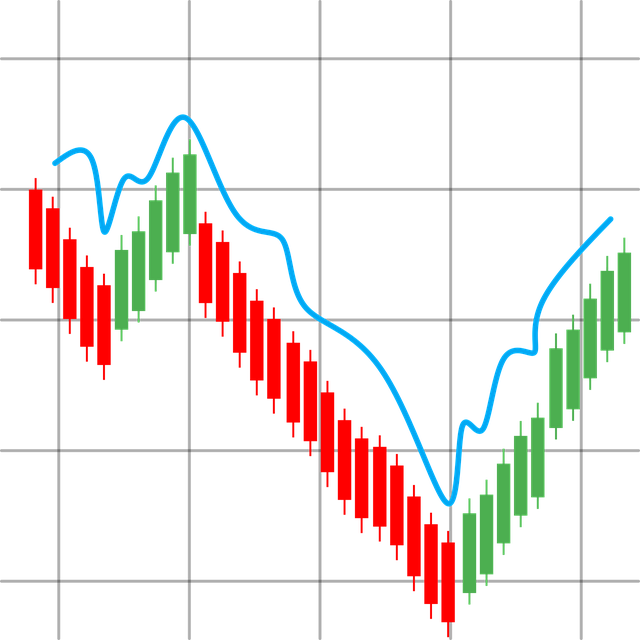

Step back: There have been moments over the past 12 months when investors have tried to reduce their exposure to high-growth companies, which don’t look as attractive in a world where interest rates could begin to rise. But on the whole, tech and Tesla have remained the undisputed market champions — even if the basket of winners looks slightly different.

A question that often arises when looking at the small number of companies that power the S&P 500 is whether the concentration makes the market vulnerable to a larger pullback. If something happens to Nvidia, for example, will everyone get hurt — whether they own stock in the company or not?

Goldman Sachs thinks that as it stands, the risk is low. The investment bank said investors have already priced in the beginning of interest rate hikes …….

Source: https://www.cnn.com/2021/12/13/investing/premarket-stocks-trading/index.html