Why bad news is bad news for the stock market: Morning Brief – Yahoo Finance

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Friday, January 6, 2023

Today’s newsletter is by Alexandra Semenova, markets reporter at Yahoo Finance. Follow Alexandra on Twitter @alexandraandnyc. Read this and more market news on the go with the Yahoo Finance App.

Investors have heard the adage a lot lately — good news is bad news, and vice versa.

In today’s economy, positive data on job growth, manufacturing, and consumer spending have been perceived as a sign the Federal Reserve will remain aggressive in raising interest rates to slow growth and inflation.

And higher rates are bad for investors.

See Thursday’s action for the latest example. After the ADP’s private payroll report showed employers added a robust 235,000 jobs last month and unemployment claims fell to a three-month low last week —seemingly good news about the economy — stocks sank.

On the flip side, potential signs the economy is softening could bring in optimism from some investors the Fed will be inclined to stop or slow its rate hiking campaign, a positive for risky assets like stocks.

In 2023, however, some investors don’t see this dynamic enduring as the much-anticipated recession in the U.S. draws near. Huw Roberts, director of research at QuantInsights, explained this environment well in an interview with Yahoo Finance Live earlier this week.

“The dynamic that we have witnessed before whereby bad economic news was almost seen as good news, in a sense that it stayed the Fed’s hand, and maybe brought in a lower terminal rate — that’s starting to shift,” Roberts said.

“And bad news just reflects a recession, reflects poor earnings, and is bad news for stock markets, and I suspect there’s a degree of that thinking going on.”

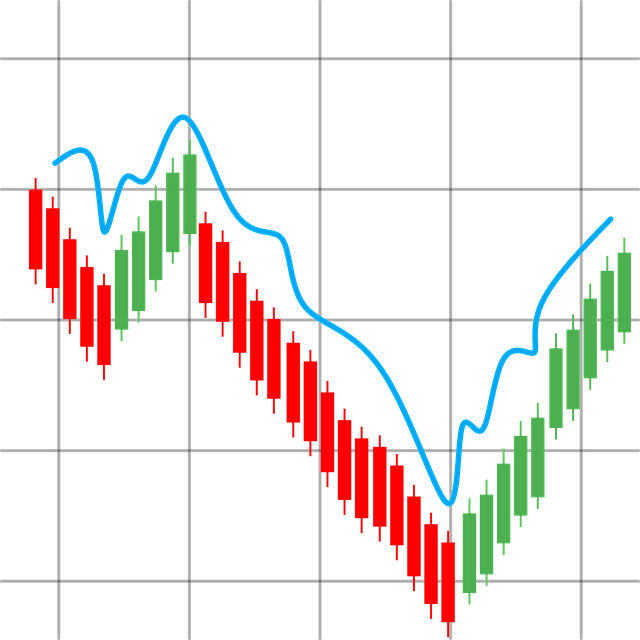

For many Wall Street strategists, Roberts’ outline tracks with their stock market forecast for 2023. Wall Street’s “consensus” idea for this year was stocks falling in the first half of the year as a recession starts, and rebounding in the second half as the Fed eases off rate hikes.

Goldman Sachs strategists see stocks lower in the first half of the year before finishing flat in 2023. (Source: Goldman Sachs)

But how close the economy actually is to this highly-anticipated recession seems perpetually pushed further out by incoming data.

The labor market has been persistently tight, with job openings still high and unemployment still …….